Is this the second big wave of Treasury technology implementation? Or did the first wave never slow down? Either way, it is very satisfying to see the advancement of this core function.

Often treasurers question the benefits of implementing treasury technology and the return they would get from it.

For those, here is a sample of the pros:

Cash visualisation – the base to centralise vital information for Treasury activities, promotes the ability to manage liquidity across legal entities and internationally from a centralised location, identifying opportunity to optimise capital and potentially reduce cost of debt

Controls – as core functionality, Treasury systems present best practice and auditable workflows, with focus on reducing manual processes and improve audit trail

Improved forecasting – ability to integrate planned activities in order to support liquidity and hedging decisions. Also generates reporting and comparison of forecasted versus actual cash flows that can be used to identify areas for improvement such as internal communication

Staff morale - providing the appropriate tools for the staff to thrive, empowering them and at the same time guaranteeing the necessary controls that may make a difference when retaining the qualified professional. Changing a tire without a jack has its challenges, especially when the competition is moving fast and is carrying the latest tools!

Companies are expanding, increasing complexity, often holding several bank accounts across the globe; technology is the facilitator to lift Treasury functions and allow for success on this evolution.

There is technology at different price points and at a sophisticated level, so no company is too small or too complex to use a treasury system. Treasury Technology is sold by modules, so the client is able to prioritise, work with the budget and plan staff resources when choosing a module. Modules can be implemented separately and you may often find different modules at a different stage of implementation. You may be working live with one module and write requirements for another if that is the desired approach to implementation.

It is difficult to provide cons for this helpful tool, however there are decisions to be made, such as identifying the right vendor and the modules that will add value to your operations in order to achieve the desired savings and risk mitigation. The main financial gains are related to savings on staff time, scalability, improved liquidity planning, and potential reduction of debt and hedging costs.

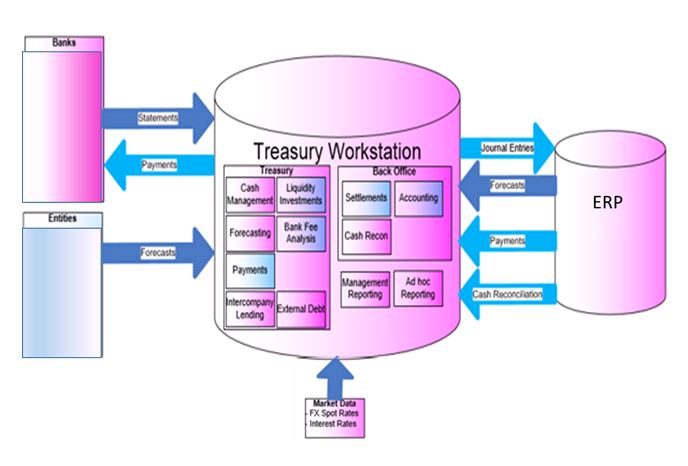

Sample future state of a Treasury system implementation:

Identifying that a Treasury Management System is needed is the first step into the world of taking your Treasury to the next level. Here are the next steps:

Identifying that a Treasury Management System is needed is the first step into the world of taking your Treasury to the next level. Here are the next steps:

- Understand your processes and gaps: put the structure down on paper, as well as the network of processes and parties involved, dependencies, costs, hours spent, gaps on controls, so you can access your real needs.

- Draft the future state: how do you envision the processes once implementation is done and what are the requirements?

- Prioritize: the world wasn’t made in a day and it will take more than that to build your first-class Treasury group. Prioritising is key when “selling” the idea internally, working with a budget and communicating with vendors.

In this phase, it is very important to be open to change as processes can be streamlined and trying to fit current processes into a technology system may not be the best way to go.

- Network: making an informed decision always goes a long way and there are no exceptions here, so understand what the market has to offer, gather feedback from who embraced technology and learn from their success or mistakes.

- Identify top vendors: once you have done your homework and have a solid case in hand, approach the vendors by submitting your scenario and identify if they are able to support your initiative. Some Treasury systems are stronger on different aspects, from being user friendly to being easy to configure, from most features pre-built and ready to go to complex systems that would accommodate highly customizable requirements, such as sophisticated investment structures.

- Narrow the relationships and dig into the details: once the potential partnership has been identified, it’s time to kick-off conversations!

This can be done more formally via an RFI and RFP process, or narrowing discussions to vendor demonstrations of capabilities and use cases, either way it is beneficial to create a score card that outlines the priorities and how each vendor scores on the categories.

- Go back to the drawing board: verify if the vendors out there can support your requirements and the vendors that score the highest on your priorities access vendors using a quantitative methodology. Be as rational as possible and with the future state of the company in mind.

- Calculate the total cost and negotiate contract terms: Costs involved are typically around implementation and subscription if hosted systems or upgrades down the road will require extra support that may have an additional cost. Registering the identified gaps and vendor commitments in the agreement prior to disbursements is a good way to ensure that they will be addressed.

- Prepare the stakeholders, create the implementation team and “get ready”: TMS implementation is the typical “short term pain for long term gain”, so planning around resources should be as realistic as possible and it is important and fundamental to achieve the established “Go Live” date.

- Close the deal and embrace the change!

A piece of advice from Chad Wekelo, Actualize’s founder and Principal is to “spend time upfront, identifying the priorities, defining the requirements and envisioned architecture. This will make the process and communication with vendors and stakeholders a lot easier. Also DO spend time in use cases and identify the gaps with vendors early on in the process, so when you are entering the implementation phase, there are no unpleasant surprises.”

Priscila Nagalli is an economist, CFA and CTP charterholder with 15 years of international cash, investments, debt, compliance, and risk management experience combined with background working with structured funding scenarios on both emerging and developed markets. She has worked in Brazil, Canada and the US and held progressive roles in banking, pension fund, corporate treasury and consulting. Priscila has analysed and implemented several Treasury Management System solutions and helped companies reengineering and improve their Treasury activities including designing Foreign Exchange hedging program, Liquidity, Debt, Payments and Cash Management processes. Priscila currently works for Actualize Consulting, with focus on Corporate Treasury.

Priscila Nagalli is an economist, CFA and CTP charterholder with 15 years of international cash, investments, debt, compliance, and risk management experience combined with background working with structured funding scenarios on both emerging and developed markets. She has worked in Brazil, Canada and the US and held progressive roles in banking, pension fund, corporate treasury and consulting. Priscila has analysed and implemented several Treasury Management System solutions and helped companies reengineering and improve their Treasury activities including designing Foreign Exchange hedging program, Liquidity, Debt, Payments and Cash Management processes. Priscila currently works for Actualize Consulting, with focus on Corporate Treasury.